TECH COMIC

For more

"One Year in an IT Project" Cartoon

Click here

Investments in information technology have become crucial for firms to improve the quality of their products and services. Investment in information technology or information system has increased over a decade. “IT spending has grown 166 percent per decade since the 1970s as companies looked to technology as the “silver bullet” to spur their business growth” (Cohan 2005). Investing in IT/IS is very crucial for all businesses in every industries. For example, “The foodservice operators must adopt technology as more than simply a cost of doing business. They must view it as a tool to help them attain their strategic business objective.” (Rubinstein 1997) At the same time, there are numerous possible IT projects that firms could invest in, such as, e-commerce, ERP system, new software development, etc. Due to the limited resources and time, companies must wisely choose to invest in the projects that match their business and economic goals. Therefore, the feasibility study is an integral part during the planning phase of the system development life cycle (SDLC).

(For more information on SDLC, visit http://en.wikipedia.org/wiki/Systems_Development_Life_Cycle)

One of the feasibility factors that need to be assessed is economic feasibility. Management can assess economic feasibility by doing the cost-benefit analysis, as well as using financial techniques, such as time value of money or break-even point analysis. In addition to the economic feasibility analysis, this paper will also look at some other feasibility factors, such as technical, operational, scheduling, legal and contractual, and political feasibility.

_____________________________________________________________________________________________________

A feasibility study, also known as feasibility analysis, is an analysis of the viability of an idea. It describes a preliminary study undertaken to determine and document a project’s viability. The results of this analysis are used in making the decision whether to proceed with the project or not. This analytical tool used during the project planning phrase shows how a business would operate under a set of assumption, such as the technology used, the facilities and equipment, the capital needs, and other financial aspects. The study is the first time in a project development process that show whether the project create a technical and economically feasible concept. As the study requires a strong financial and technical background, outside consultants conduct most studies. (Matson 2000)

A feasible project is one where the project could generate adequate amount of cash flow and profits, withstand the risks it will encounter, remain viable in the long-term and meet the goals of the business. The venture can be a start-up of the new business, a purchase of the existing business, and expansion of the current business (Hofstrand and Holz-Clause, 2006).

_____________________________________________________________________________________________________

Developing a new IT/IS project is difficult, complex, and time consuming. There are many ideas that do not develop i

nto business operation. Even though these ideas make it to the operational stage, most fail within the first six months.

- According to the CHAOS report (2004) by the Standish Group, 15% of IT projects were canceled before they ever got completed in 2004. 20% of the projects were cost over 43% of their original estimate. Also, only 34% of the software projects were complete on time and on budget (even though it’s up from 16.2% in 1994).

Therefore, before investing in the proposed project, one must determine whether that IT projects can be economically viable and the investment advantages outweigh the risks involved (Matson 2000). Also, many IT projects are quite expensive to conduct and it also involve unfamiliar risks.

- The total spending in IT projects was $255 billion in 2004. (The CHAOS report 2004)

- “IT spending has grown 166 percent per decade since the 1970s as companies looked to technology as the “silver bullet” to spur their business growth. Yet, with all the billions spent, the returns on those investments are hard, if not impossible, to fully gauge. (Cohan 2005)

Moreover, there are numerous possible IT projects that firms could invest in. If companies had unlimited resources and infinite time, all projects would be feasible (Pressman 2005). However, in the real world business, there are problems of scarcity of both time and resources. Management is constantly faced with a wide array of possible investment alternatives and forced to choose one project over the others. Also, most projects must be developed within the time constraints and under the limited budget.

The feasibility study allows us to preview the potential outcome and to decide whether they should continue. Although the cost of conduct this study may seem high, there are relatively minor when compared with the total project cost. This small initial expenditure on feasibility study can help to prevent larger loss later._____________________________________________________________________________________________________

Chen (1996) classifies types of capital investment into three board areas, depending on their impact on cooperate profit:

- New Profit : expansion of product volume, cost savings, or to enter into new operations.

- Business Protection : maintaining present capacity to do business and avoid loss of existing profits.

- Obligatory Investment : necessary investment to provide safety for employees, meet government regulations such as pollution control, and providing modern facilities for employees.

Only new profit investments will increase a corporation’s rate of return. The business protection investments help maintain corporate profitability, but usually won’t increase it. Pure obligatory investments may not pass the profit tests, as it will reduce corporate profitability from prior-year levels; however, it could expand its scope to include profitable item to justify the investment.

_____________________________________________________________________________________________________

Estimation is to figure out the approximate result which is usable even if input data may be incomplete or uncertain [1]. Estimating is the main part of feasibility analysis. In doing the estimation for IT/IS project, there are four major variables that need to be considered; time, requirements, resources (cost, labor, materials, infrastructure), and risks. Unexpected changes in any of these variables will impact an outcome of the project. Therefore, making good estimates of time and resources for a project is crucial.

Underestimating project needs may cause the inadequacy of time, money, infrastructure, materials, or people to complete the project while overestimating needs can lead to reject of this adequate project, or postpone the project because it is too expensive.

According to the Article in developer.com [2] , Estimates can be roughly divided into three types; Fair estimates, Rough estimates, and order of magnitude estimates.

- Fair estimates: This is a very good estimate. It will be only 25% to 50% off the actual value. Fair estimates are possible when you are very familiar with the project as you may have done it many times before, such as maintenance type project where the fixes are known, and it has been done before.

- Rough estimates: The estimate is closer to the actual value. Ideally it will be about 50% to 100% off the actual value. Rough estimates are possible when working with well-understood needs and one is familiar with domain and technology issues.

- Ballpark or order of magnitude: The estimate would fall within two or three times the actual value. Most estimation, especially for the estimation of a new project, is fall within this type. Some may think that this type of estimation is close to no estimate at all. However, the order of magnitude estimates are very valuable because they give the organization and project team some idea of what the project is going to need in terms of time, resources, and money. It is better to know that project is going to take between two and six months to do rather than have no idea how much time it will take at all.

Knowing which of these three different estimates you can provide is crucial. Also, in many cases, we may be able to give more detailed estimates for some items rather than others. For example, we may be able to provide a rough estimate of the infrastructure we need but only an order of magnitude estimate of the people and time needed.

Estimation Technique for new projects (Order of magnitude estimates)

combinations of complexity and size. For example, a less complex task may still involve a large amount of work, such as, loading a database from paper forms.

Estimation Techniques familiar projects (Rough or Fair estimates)

According to Murthi (2002)’s article in developer.com, system analyst could estimate familiar projects by doing Rough or Fair estimates by follow these following techiniques:

_____________________________________________________________________________________________________

There are several techniques for cost estimation, but the 2 basic approaches are top-down and bottom-up.

- Top-down approach: Cost is derived from a business analysis of the major project components, or start with the management’s expectations on the range of costs. Then, figure out what you can deliver for those numbers.

- Bottom-up approach: Cost is derived by accumulating estimates from the people responsible for various components. By doing the bottom-up approach, one would break down a task into small components, estimate each piece, and add the estimate together.

The primary techniques for cost estimation are [3] & [4] :

Description

Advantage

Disadvantage

Expert Judgments

Using experts in both software development and the application domain to predict software costs.

- Relatively cheap estimation method.

- Accurate if experts have direct experience of similar systems.

- Very inaccurate if there are no experts!

Estimation by Analogy

Using the cost of a similar project in the same application domain

- Accurate if project data available

- Impossible if no comparable project has been tackled.

- Needs systematically maintained cost database

Parkinson's Law

Using any available resources.

- No overspend

- System is usually unfinished

Pricing to Win

The project costs whatever the customer has to spend on it

- Get the contract

- The probability that the customer gets the system he or she wants is small.

- Costs do not accurately reflect the work required

Algorithmic Cost Modeling

_____________________________________________________________________________________________________

Economic evaluation is a vital part of investment appraisal, dealing with factors that can be quantified, measured, and compared in monetary terms (Chen 1996). The results of an economic evaluation are considered with other aspects to make the project investment decision as the proper investment appraisal helps to ensure that the right project is undertaken in a manner that gives it the best chances of success.

Project investments involve the expenditure of capital funds and other resources to generate future benefits, whether in the form of profits, cost savings, or social benefits. For an investment to be worthwhile, the future benefit should compare favorably with the prior expenditure of resources need to achieve them.

To assess economic feasibility, management has to analyze costs and benefits associated with the proposed project. The capital cost of a project affects the economic evaluation. Cost estimating is essentially an intuitive process that attempts to predict the final outcome of a future capital expenditure (Chen 1996). Even though it seem impossible to come up with the exact number of costs and benefits for a particular project during this initial phase of the development process, one should spend the adequate of time in estimating the costs and benefits of the project for comparison with other alternatives.

When talking about the cost of IT/IS project, one would first think of the tangible costs that are easily to determine and estimate, such as hardware and software cost, or labor cost. However, in addition to these tangible costs, there are also some intangible costs, such as loss of goodwill, or operational inefficiency.One methodology for determining the costs of implementing and maintaining information technology is Total Cost of Ownership (TCO). It is a financial estimate designed to help consumers and enterprise managers assess direct and indirect costs. Bill Kirwin, VP and Research director of Gartner, stated that “TCO is a holistic assessment of IT costs over time. The term holistic assessment implies an all-encompassing collection of the costs associated with IT investments, including capital investment, license fees, leasing costs, and service fees, as well as direct (budgeted) and indirect(unbudgeted) labor expenses”.[5] An advisory firm Garter, Inc. has identified and offered statement on the financial impact of deploying information technology during its whole life-cycle as following [6]:

- End-user computer Hardware purchase costs

- Software license purchase costs

- Hardware & Software deployment costs

- Hardware warranties and maintenance costs

- Software license tracking costs

- Operations Infrastructure Costs

- Cost of Security Breaches (in loss of reputation and recovery cost)

- Cost for electricity and cooling

- Network hardware and software costs

- Server hardware and software costs

- Insurance costs

- Testing costs

- Cost to upgrade or scalability

- IT Personnel costs

- "C" Level Management Time costs

- Backup and Recovery Process costs

- Costs associated with failure or outage

- Diminished performance incidents (i.e. users having to wait)

- Technology training costs of users and IT staff

- Infrastructure (floor space) costs

- Audit costs

- Migration costs

On the other hand, IT/IS projects can provide many benefits, both tangible and intangible, to an organization. The tangible benefit, such as cost saving or increasing in revenue, would be easier to estimate while intangible benefits are harder to quantify. The examples of benefits in IT/IS projects are shown in many articles.

- Meta Group’s Executive Vice President Howard Rubin and Battery Venture’s General Partner Dave Tabors suggest that IT accounts for most of this productivity improvement. (Cohan 2005)

- Kevin Moody, director of Babson College’s Center for Information Management Studies (CIMS), suggests that companies have recently reduced some of their IT costs be a factor of 10 by replacing expensive servers running proprietary software with cheaper blade servers running on Linux. (Cohan 2005)

There are several economic evaluation methods available to assess an investment. The most widely used methods are Net Present Value (NPV) and Discounted Cash Flow Rate of Return, or Internal Rate of Return (IRR). Even though, NPV approach and IRR approach will normally provide the same decision result, polls of industry indicate that the IRR is the number one economic evaluation decision method use by about two-thirds of industrial companies (Chen 1996). This is due to the fact that some managers prefer a percentage rate of return more than the dollar amount from NPV.

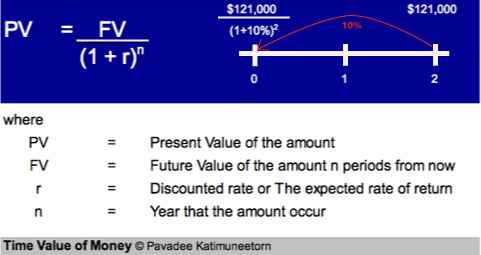

Before calculating NPV and IRR, one should have an understanding of basic finance concept called “Time value of money”. The concept of Time value of money is that a dollar today is worth more than a dollar available at a future date because a dollar today can be invested and earn a return. Someone investing a sum of money today at a given interest rate for a given period of time would expect to have larger sum of money at the future date (Baker and Powell 2005). As different projects may provide benefits at the different time in the future, all costs and benefits of the projects should be viewed in relation to their present value.

Present value is the value of a future cash stream discounted at the appropriate market interest rate, called discount rate. The present value of the future cash flow can be calculated using the following equation:

Net Present Value (NPV)

Internal Rate of Return (IRR)

Concept

Adding the present values of each individual positive or negative cash flow based on the opportunity cost of capital. In this case the present is taken as the time at which evaluation is carried out. (Chen 1996)

The discount rate at which the net present value of an investment is zero. (Ross, Westerfield, and Jaffe)

Decision Rule

(from Baker and Powell)

For independent projects,

- Accept if NPV is greater than zero

- Reject if NPV is less than zero

For mutually exclusive projects (choose one project over others), accept the project with the highest positive NPV.

For independent projects,

- Accept if IRR is equal or greater than required rate of return.

- Reject if IRR is less than required rate of return.

For mutually exclusive projects, accept the project with the highest IRR that is greater than required rate of return.

Strengths

(from Baker and Powell)

- NPV is a direct measure of a project’s dollar benefit.

- NPV approach fully accounts for time value of money and considers all cash flow over the life of the project.

- NPV assumes that firms can reinvest all of the cash inflow at the project’s required rate of return throughout the life of the project. This rate is more realistic than the IRR rate.

- NPV approach provides the accept-reject decision for both independent and mutually exclusive project.

- IRR measures profitability as a percentage showing the return on each dollar invested.

- IRR approach fully accounts for time value of money and considers all cash flow over the life of the project.

- IRR provides the safety margin information to management. Thus, the higher IRR is the safety margin.

- Some managers prefer the IRR because they like dealing with the percentage rates of return more than with the dollar value in NPV.

Weaknesses

(from Baker and Powell)

- NPV does not provide a gauge for relative profitability. For example, NPV $1,000 is highly desirable for a project costing $2,000 but not for a project coating $1 million. NPV only provide the total profits gained, but not the percentage gained.

- Some people have difficulty understanding the meaning of NPV measure. Therefore, in practice, managers often prefer a percentage return to a PV of dollar return.

- IRR method can provide no IRR or multiple IRRs if a project has a non conventional cash flow pattern, such as, cash flow pattern has more than one sign change (-/+/-).

- IRR assumes that firms can reinvest all of the cash inflow at the IRR rate throughout the life of the project. This rate may be unrealistic.

- IRR may lead to inconsistence of ranking for mutually exclusive projects as it does not provide the magnitude or duration of its cash flow.

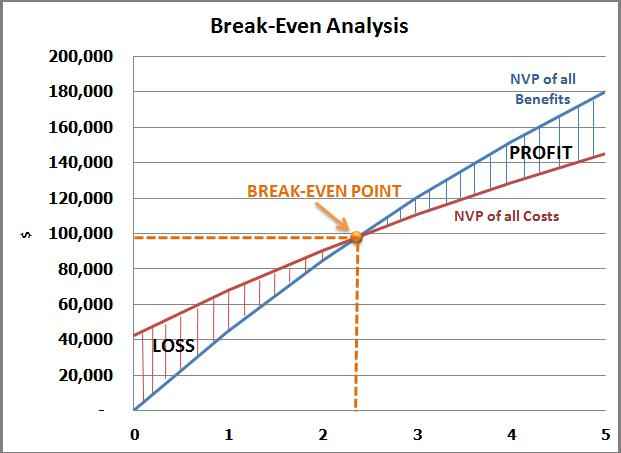

Break-even analysis is a type of cost benefit analysis to identify at what point (if ever) benefits equal costs (Hoffer, George, and Valacich).

Break-Even Ratio = Yearly NPV Cash Flow – Overall NPV Cash Flow

Yearly NPV Cash FlowThe break-even point is usually expressed as the amount of revenue that must be realized for the firm to have neither profit or loss. It expresses a minimum revenue target. (Marshall, McManus, and Viele) It can be expressed in numbers or by the use of graphs.

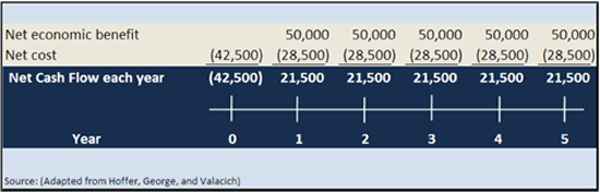

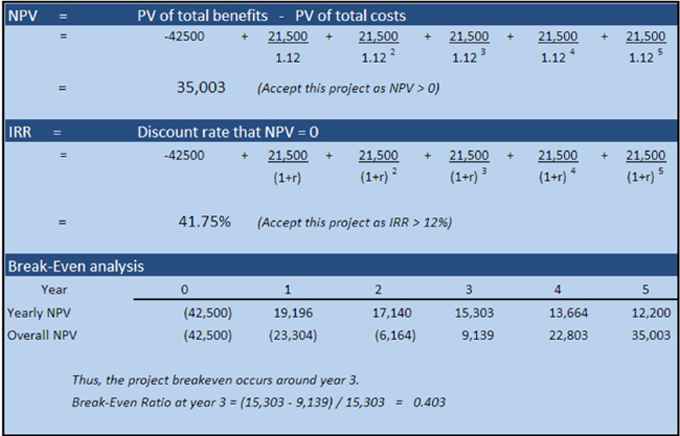

A system analysts estimate the cost for the new system as $42,500 one time investment for developing, updating hardware, and user training. Also, firm needs to pay $28,500 each year for software maintenance, incremental communication cost, and supplies. On the other hand, the system will provide approximately $50,000 per year. Assume the expected rate of return (discount rate) is 12%.

After determining costs and benefits of a new system, the system analysts evaluate the project using NPV, IRR, Break-even analysis, or other methods. Also, using a time diagram is helpful to illustrate the timing of cash flows, especially for situations involving cash flows at the different points in time that are not equal (Baker and Powell 2005).

Also, there are other financial methods that are used to evaluate the project investment.

- Return on investment (ROI) equals to net cash receipts of the project divided by the cash outlays of the project. Firms choose the project that provides the highest ROI. (Hoffer, George, Valacich)

- Payback period (PP) is amount of time required for an investment to generate sufficient cash flows to recover its initial cost. Payback period is similar to the break-even analysis, except the fact that payback period ignores the concept of time value of money. (Baker and Powell)

- Profitability index (PI) shows the relative profitability of any investment. It equal to the present value of cash inflow divided by present value of cash outflow. (Baker and Powell)

_____________________________________________________________________________________________________

Assessing technical feasibility is to evaluate whether the new system will perform adequately and whether an organization has ability to construct a proposed system or not. The technical assessment help answer the question such as whether the technology needed for the system exists, how difficult it will be to build, and whether the firm has enough experience using that technology. One examples of the technical feasibility is shown in the credit union management.

- “It worked great and clients were happy with it and felt that it met their needs, but obviously that platform needed to be upgraded to meet the current technology direction for the industry. It was no longer going to be supportable long-term” said Sara L. Brooks, chief strategy officer for Fiserv’s credit union division. (Swedberg 2005)

- Even though a particular operating system may run on different computer architectures, the software written for that operating system may not automatically work on all architectures that the operating system supports. For example, in 2006, OpenOffice.org did not natively run on the processors implementing the 64-bits standards for computers.[7] Therefore, implementing the OpenOffice at that time would not be feasible in technical term if the company have 64-bits computer architectures.

In developing the new system, one has to investigate and compare technology providers, determine reliability and competitiveness of that system, and identify limitations or constraints of technology, as well as the risk of the proposed system that is depend on the size of the system, complexity, and group’s experience with the similar systems.

duration time, number of department involved, or the effort put in programming. (Hoffer, George, and Valacich) The larger the size of the projects, the riskier the project is. The CHAOS Report (1999) confirms that small projects are more likely to succeed than large projects. “The smaller the team and the shorter the duration of the project, the greater the likelihood of success.” (CHAOS Report 1999)

- Project Structure: The project that its requirements are highly structured and well define will have lower risk than the one that the requirements are subject to the judgment of an individual.

- Familiarity with Technology or Application area: The project will be less risky if the development and the user group is familiar with the technology and the systems. Therefore, it would be less risky if the development team uses the standard development tool and hardware environments. Also, on the users’ side, the more users familiar with the systems development process, the more likely they understand the need for their involvement; this involvement can lead to the success of the project.

However, one thing to keep in mind is that a project with the highly risk may still be conducted. Most company would have the reasonable combination among high-, medium-, and low-risk projects. Without the high-risk project, the organization couldn’t make the major breakthroughs in innovative uses of systems. (Hoffer, George, and Valarich)

_____________________________________________________________________________________________________

Assessing operational feasibility is to gain an understanding of whether the proposed system will likely to solve the business problems, or take advantage of the opportunities or not. It is important to understand how the new systems will fit into the current day-to-day operations of the organization.

Also, system analysts need to assess whether the current work practices and procedures support a new system and how the organizational changes will affect the working lives of those affected by the system. (Jaffe 1967) Implementing the new IT/IS project may cause some obstructs and may increase difficulty to the staffs in their day-to-day operation.

_____________________________________________________________________________________________________

Assessing schedule feasibility is to assess the duration of the project whether it is too long to be complete before it is useful. System analysts have to estimate how long the system will take to develop, and whether all potential timeframes and the completion date schedules can be met, as well a

s whether meeting these date will sufficient for dealing with the needs of the organization.

- The project would not be feasible in term of schedule if the project should be use to provide the benefit for the event occurs in up coming summer, but it schedules to be done 4 months after that summer.

Moreover, another thing to consider is the learning curve of the new technology and new system. We may have the technology, but that doesn't mean we have the skills required to properly apply that technology. Even though all information systems professionals can learn new technologies, the learning curve will specifically impact the schedule feasibility.

Also, one needs to determine whether the deadlines are mandatory or desirable. Unless the deadline is absolute mandatory, it is preferable to deliver a properly functioning information system two months late than to deliver an error-prone, useless information system on time. Missed schedules are bad, but inadequate systems are worse. [8]_________________________________________________________________________________________

Legal feasibility determines whether the proposed system conflicts with the legal requirement or not. A project may face legal issues after completion if this factor is not considered at the first stage. [9]

______________________________________________________________________________________________________

Assessing political feasibility is to gain an understanding of how key stakeholders within the organization view the proposed system. The new information systems may affect the distribution of power and can have political ramification. Therefore, those stakeholders not supporting the project may block or disrupt the project.

- High-tech personal devices are costly to purchase and maintain- how much depend on the device and usage. So is the device cost-effective and is there are real need for this device to get work done outside of the office? Or is the device provided more as a convenience or status symbol? (For example, "The guy next door has one, and I'm higher up in the company than he is, so I should have one too.") (Wilbanks 2007)

____________________________________________________________________________________________________

Baker, H. Kent, and Powell, Gary E., Understanding Financial Management: A Practical Guide. Blackwell Publishing.

Chen, M.T., (1996), “ Simplified project economic evaluation.” Transactions of AACE International. ABI/INFORM Global.

Cohan, P.S., (2005), “CFOs to Tech: ‘I’ll Spend For The Right Technology’.” Financial Executive Apr 2005. ABI/INFORM Global.

Demirhan, D., Jacob, V.S., and Raghunathan, S., (2006), “Information Technology Investment Strategies Under Declining Technology Cost.” Journal of Management Information Systems. Vol. 22 No. 3, Winter 2006. pp. 321 – 350

Hoffer, J.A., George, J.F., and Valacich, J.S., Modern Systems Analysis and Design. 5th edition. Pearson Prentice Hall.

Hofstrand, D., and Holz-Clause, M., (2006), “What is a Feasibilty Study?” Ag Decision Maker. File C5-65.

Hofstrand, D., and Holz-Clause, M., (2006), “Feasibilty Study Outline” Ag Decision Maker. File C5-66.Jaffe, J., (1967), "The Systems Design Phase", in Perry E. Rosove(ed.), Developing Computer-Based Information Systems, J Wiley.

Marshall, D.H., McManus, W.M., and Viele, D.F., Accountoing: What The Number Mean. 7th edition. McGraw-Hill Irwin.

McAdams, T., Neslund, N., and Neslund, K., Law, Business, and Society. 8th edition. McGraw-Hill Irwin.

Matson, J., (2000), “Cooperative Feasibility Study Guide.” United States Department of Agriculture (USDA)

Pressman, R. S., (2005), Software Engineering, 6th ed. New York: McGraw-Hill.

Ross, S.A., Westerfield R.W., and Jaffe, J., Corporate Finance. 7th edition. McGraw-Hill Irwin.

Rubinstein, E., (1997), “Study: Information technology a strategic asset.” Nation’s Restaurant News; Nov 3,1997; ABI/INFORM Global

Swedberg, J., (2008), “The Decision Point.” Credit Union Management. May 2008

THE CHAOS Report (1999), The Standish Group International Inc.

THE CHAOS Report (2004), The Standish Group International Inc.

Willbanks., Linda (2007), "Passing out IT Toys." CIO Corner, IT Pro. November/December 2007.

[1] http://en.wikipedia.org/wiki/Estimation; viewed November 06, 2008

[2] http://www.developer.com/mgmt/article.php/1463281; viewed November 06, 2008

[3] http://www.cs.odu.edu/~zeil/cs451/Lectures/04mgmt/costest/costest_htsu3.html; viewed November 6, 2008

[4] http://www.levela.com/software_cost_estimating_swdoc.htm; viewed November 6, 2008[5] http://amt.gartner.com/TCO/MoreAboutTCO.htm; viewed November 04, 2008

[6] http://en.wikipedia.org/wiki/Total_cost_of_ownership; viewed November 04, 2008

[7] http://en.wikipedia.org/wiki/Cross-platform; viewed November 17, 2008

[8] http://www.cs.toronto.edu/~jm/340S/02/PDF2/Feasibility.pdf; viewed November 10, 2008

[9] http://en.wikipedia.org/wiki/Feasibility_study; viewed October 20, 2008

_________________________________________________________________________________________