The IRS requires Universities to collect social security numbers or individual taxpayer numbers (ITIN) for accurate tax reporting on 1098-T forms. Learn more

Listed below are step-by-step instructions on how to view and print your 1098-T tax form using the university's online portal. You may also give an authorized user access to your 1098-T tax form using this system.

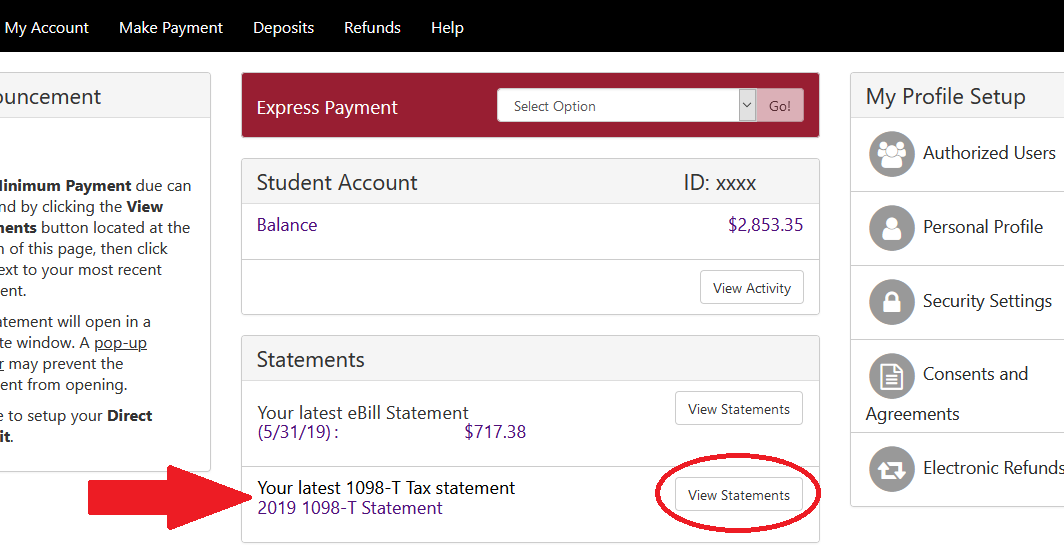

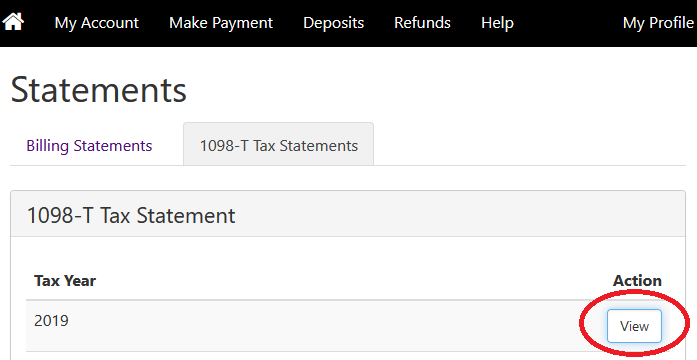

To view and print your 1098-T tax form online:

The Student Financial Services Office is not permitted to provide tax advice. Learn more about Education Tax Credits .

How to Grant an Authorized User 1098-T Access:

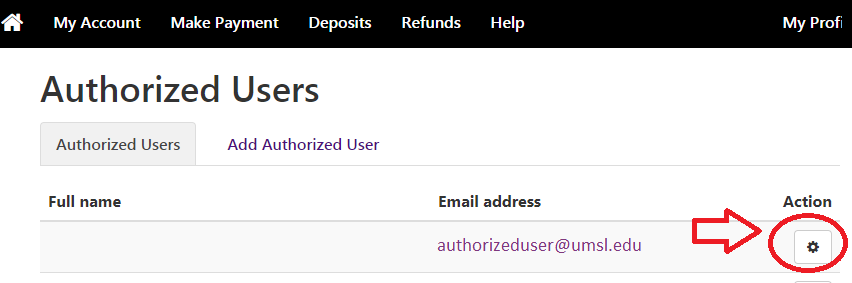

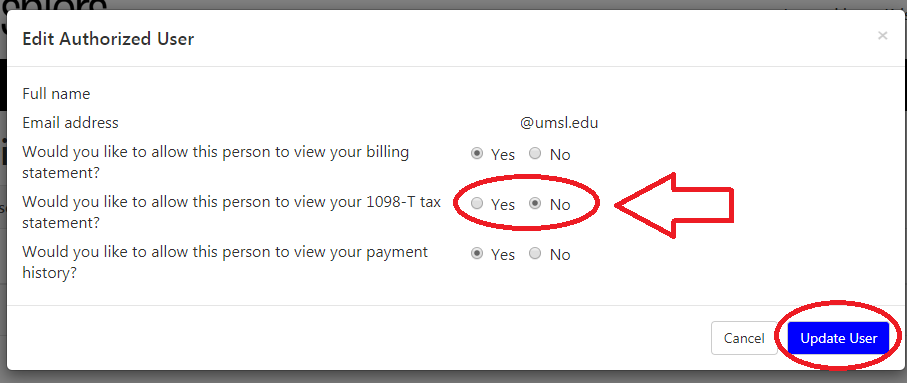

If you have an Authorized User set up in TouchNet, you will need to allow them to view your 1098T tax form before they can access it themselves.

First, login to TouchNet and click the Authorized Users link on the right hand menu.

Choose the Action button next to the User that you would like to grant access as shown below.

The Authorized User should now be able to log in to TouchNet and access the student's 1098T tax form.